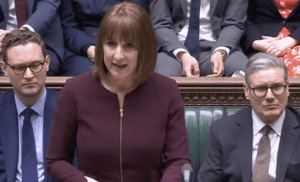

Chancellor Rachel Reeves has been warned by the Organisation for Economic Cooperation and Development (OECD) that her wafer-thin fiscal buffers could prove inadequate if the UK economy is hit by a fresh downturn, following a downgrade to the country’s growth forecast.

In its latest economic outlook, the Paris-based body revised its UK GDP growth projections downward for both this year and next. It now expects the economy to grow by just 1.3 per cent in 2025, down from an earlier forecast of 1.4 per cent, and to slow further to 1 per cent in 2026, compared to its previous estimate of 1.2 per cent.

The OECD cited rising global trade uncertainty, persistently high interest rates, and declining household and business confidence as key factors behind the weaker outlook. It warned that sluggish economic performance could jeopardise the government’s ability to meet its self-imposed fiscal rules.

“Currently very thin fiscal buffers could be insufficient to provide adequate support without breaching the fiscal rules in the event of renewed adverse shocks,” the OECD said.

The warning comes just days after the International Monetary Fund (IMF) issued a similar alert, and ahead of the government’s three-year spending review next week. Reeves is facing mounting pressure to maintain control of ministerial budgets while honouring recent policy pledges, including a reversal on plans to limit winter fuel payments for pensioners.

Reeves’s key fiscal rule is to ensure that day-to-day government spending is fully funded by tax revenues by the end of the current parliament. However, according to her own spring budget, the chancellor has left herself just £8.9 billion of headroom — among the narrowest margins on record.

The OECD urged the chancellor to deliver a “balanced” autumn budget that includes both targeted spending cuts and tax reforms. It suggested closing tax loopholes, re-evaluating council tax bands based on current property values, and eliminating distortions in the tax system to strengthen the public finances.

The report predicts that the UK’s budget deficit will fall from 6 per cent of GDP in 2024 to 4.5 per cent in 2025, helped by stronger-than-expected tax receipts. However, the country’s national debt burden is projected to continue rising, hitting 104 per cent of GDP by 2026 due to elevated borrowing costs and sustained interest rates.

It noted that further supply-side reforms — including progress on the overhaul of the National Planning Policy Framework — could help raise potential output and ease long-term fiscal pressures.

In a modest silver lining for borrowers, the OECD expects the Bank of England to begin easing monetary policy, pencilling in three interest rate cuts over the next 12 months.

On the global stage, the OECD sharply cut its forecast for world growth following President Trump’s reintroduction of steep import tariffs. It now expects global GDP to expand by just 2.9 per cent this year, down from 3.3 per cent in March.

The United States suffered one of the biggest downgrades, with growth forecast to slow to 1.6 per cent in 2025 after a strong 2.8 per cent expansion in 2024. US inflation is also expected to climb to an average of 3.2 per cent from 2.5 per cent last year.

Alvaro Pereira, the OECD’s chief economist, said: “Weakened economic prospects will be felt around the world, with almost no exception. Lower growth and less trade will hit incomes and slow job growth.”

The OECD’s caution adds further pressure on Reeves as she prepares for the first major spending review of her chancellorship, and underscores the difficult balancing act ahead as she attempts to maintain fiscal discipline while navigating a more fragile global economy.

Read more:

Reeves faces fiscal rule warning as OECD slashes UK growth forecast