China has agreed in principle to allow British citizens to travel to the country for up to 30 days without a visa, Downing Street has confirmed, following high-level talks in Beijing aimed at resetting relations and boosting economic ties.

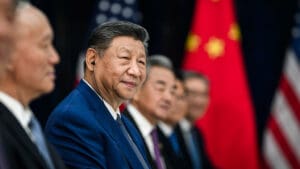

The announcement came after Keir Starmer met Xi Jinping in the Chinese capital, making him the first UK prime minister to visit China in eight years. No start date has yet been confirmed for the visa waiver, but officials said they hoped it would be implemented as soon as possible.

If enacted, the move could benefit hundreds of thousands of travellers. Around 620,000 British citizens visited China in 2024, according to the Office for National Statistics. Downing Street said the UK would be brought into line with around 50 other countries already eligible for visa-free entry, including France, Germany, Italy, Australia and Japan.

Sir Keir said relaxed visa rules would support British firms seeking to expand in one of the world’s largest markets, while also making it easier for tourists to visit China.

“As one of the world’s economic powerhouses, businesses have been crying out for ways to grow their footprints in China,” he said. “We’ll make it easier for them to do so, including via relaxed visa rules for short-term travel, supporting them to expand abroad, all while boosting growth and jobs at home.”

The visit also resulted in an agreement to halve Chinese import taxes on UK whisky from 10 per cent to 5 per cent, part of a broader effort to strengthen trade links. Downing Street said the two countries had agreed to explore negotiations on a services agreement that would create clearer, legally binding rules for UK companies operating in China.

The UK is the world’s second-largest exporter of services, including finance, legal and healthcare services, and No 10 said demand from China was increasing. A future agreement could include mutual recognition of professional qualifications, helping British firms access Chinese markets more easily.

Separately, AstraZeneca announced it would invest $15bn (£10.9bn) in China by 2030, expanding manufacturing and its workforce in the country.

Sir Keir said his discussions with President Xi at the Great Hall of the People, which lasted around 80 minutes, focused on the “huge opportunities” for cooperation, but also included sensitive topics. He said he had raised the jailing of pro-democracy campaigner Jimmy Lai and the treatment of the Uyghur minority in Xinjiang.

“Part of the rationale for engagement is to seize the opportunities available, but also to have a mature discussion about issues where we disagree,” he said.

The two countries also signed an agreement on cooperation against people-smuggling, with UK and Chinese law enforcement pledging to disrupt the supply of small boat engines and equipment used by criminal gangs. Last year, more than 60 per cent of engines recovered from Channel crossings were branded as Chinese-manufactured.

In total, 10 agreements were signed covering areas including exports, education and food safety.

President Xi said UK-China relations had experienced “twists and turns” in recent years but argued dialogue was essential in a “turbulent and fluid” world. He praised previous Labour governments for their role in developing ties between the two countries.

The visit drew criticism from opposition figures. Conservative shadow home secretary Chris Philp accused the prime minister of “kowtowing” to Beijing and risking national security, while Liberal Democrat foreign affairs spokesman Calum Miller said the approach was “all give and no take”.

Sir Keir has travelled with a delegation of British business and cultural leaders and said he wanted a “more sophisticated” relationship with China, stressing that global events have direct consequences for UK households and economic security.

The trip comes amid heightened global trade tensions after Donald Trump threatened steep tariffs on Canada over closer ties with China, underlining the geopolitical sensitivities surrounding the UK’s renewed engagement with Beijing.

Read more:

China to allow visa-free travel for British visitors as UK seeks closer trade ties