Investing in triple-leveraged ETFs may not be on your radar. But that may change after you watch this video.

Tom Bowley of EarningsBeats shares how he uses the 3x leveraged ETFs to take advantage of high probability upside moves. Tom shows charts of 3x leveraged ETFs that mirror their benchmark — TNA (Russell 2000), SOXL (Semiconductors), and LABU (Biotech), and maps out how you can use the setups in these charts to multiply your returns.

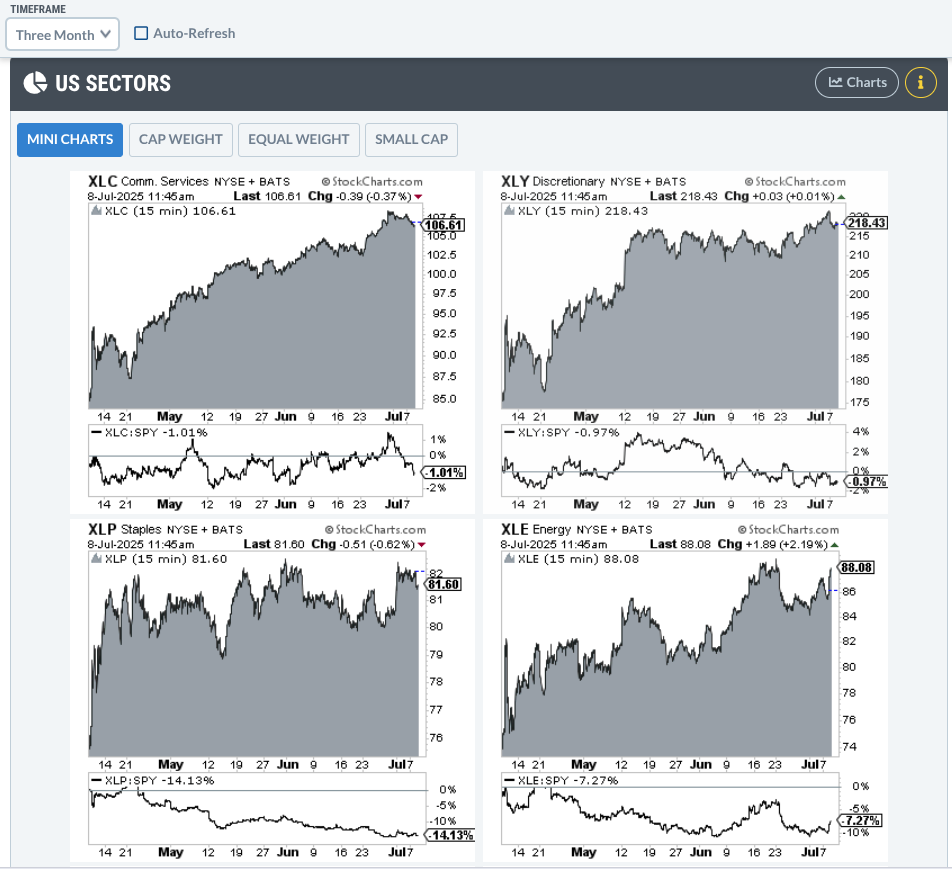

With money rotating heavily into growth stocks, investors should be looking for opportunities. Tom shares charts of indexes, sectors, and individual stocks/ETFs that are displaying technical strength and strong accumulation patterns.

Ready to multiply your returns while the market’s moving higher? Watch Tom chart out the trades he’s making today.

This video was published on July 10. Click this link to watch on Tom’s dedicated page.

Missed a session? Archived videos from Tom are available at this link.