Airlines are facing a sharp rise in operating costs after jet fuel prices surged to their highest level in more than three years amid escalating conflict in the Middle East, raising fears of prolonged disruption to global energy supplies.

The price of aviation kerosene in European markets has climbed to levels not seen since the shortages triggered during the Covid-19 pandemic, placing immediate pressure on airline margins and sending aviation stocks lower.

The spike has been particularly severe because jet fuel prices have moved far beyond the rise in crude oil prices. Brent crude has climbed by more than 10 per cent this week to around $78.60 per barrel and is roughly 20 per cent higher than it was a fortnight ago. However, the cost of jet fuel delivered to airlines has risen significantly faster, creating an unprecedented gap between aviation fuel and crude oil benchmarks.

According to commodity pricing specialists Argus Media, the cost of jet fuel physically supplied to airlines has increased by about 23 per cent over the past week alone. The price is now 48 per cent higher than last Friday and has surged by 68 per cent over the past month.

Market participants have described trading conditions as highly unstable. Analysts said the jet fuel market had entered a period of extreme volatility as traders struggled to price in the risks created by military tensions in the Gulf.

Amaar Khan, an analyst at Argus Media, said the current market dynamics were extraordinary. Even though supply risks linked to the conflict are real, he said traders believed the current price spike had become detached from normal supply-and-demand fundamentals. One trader described the situation as “absolute chaos”, noting that “no fundamentals can explain these prices”.

The aviation sector’s exposure to the Middle East has amplified the shock. European airlines depend heavily on jet fuel imports from the Gulf region, with a significant share of those shipments passing through the Strait of Hormuz, one of the world’s most critical maritime energy corridors.

Industry data suggests that at least 40 per cent of Europe’s jet fuel imports last year originated from the Middle East Gulf region and travelled through the strait. Kuwait alone accounted for a substantial portion of these supplies and remains Europe’s largest single supplier of aviation fuel.

The Strait of Hormuz has effectively become a flashpoint for global energy markets after Iran imposed a blockade in response to military attacks carried out by the United States and Israel. The narrow waterway, which sits between Iran and the United Arab Emirates, serves as the primary export route for oil and gas shipments from the Persian Gulf.

Any sustained disruption to traffic through the strait could severely restrict global fuel supplies, particularly for jet fuel, which is already in tight supply across Europe.

Analysts warned that while European refineries could increase their production of jet fuel to offset some of the disruption, they would struggle to replace Gulf imports entirely if the conflict continued.

Argus noted that Europe’s aviation fuel market had already become structurally tighter in recent years due to rising travel demand following the pandemic recovery. With refiners operating near capacity, there is limited scope to increase output quickly enough to compensate for any prolonged interruption to Gulf shipments.

At the same time, the cost of transporting fuel from alternative regions has also risen sharply. Freight rates for tanker shipments have surged as insurers raise premiums on vessels travelling through conflict-affected waters, making imports from other regions significantly more expensive.

The result has been a dramatic increase in jet fuel prices relative to crude oil. Aviation fuel is now trading at almost double the price of Brent crude, a differential that analysts say has never previously been recorded.

For airlines, the timing of the price spike is particularly challenging because fuel typically represents between 25 and 35 per cent of operating costs. Even short-term volatility can therefore have a significant impact on profitability.

Shares of European airline groups have already reacted to the rising costs and growing uncertainty surrounding Middle Eastern airspace.

International Airlines Group has seen its share price fall about 16 per cent from the record high it reached last week when it reported strong annual results. The airline group, which owns carriers including British Airways, Iberia and Aer Lingus, faces both higher fuel costs and operational disruptions on long-haul routes through the region.

Budget airline easyJet has also seen its shares fall around 6 per cent this week. The carrier does not operate routes directly in the Middle East but remains vulnerable to rising fuel costs across the industry. Its stock had already been under pressure, declining roughly 15 per cent since the start of the year.

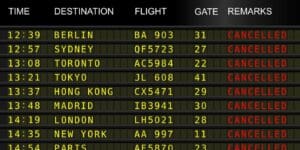

Meanwhile Wizz Air warned that the conflict could cut €50 million from its annual profits due to cancelled regional flights and adverse movements in fuel and currency costs. The airline has said the combined impact could push it into a full-year loss, with its shares dropping about 20 per cent over the past week.

Airlines have sought to protect themselves from fuel volatility through hedging strategies that lock in fuel purchases months or even years in advance. These hedges can soften the immediate impact of price spikes but cannot fully shield carriers if elevated costs persist for a prolonged period.

Europe’s largest airline by passenger numbers, Ryanair, recently confirmed that it has forward-purchased approximately 80 per cent of its jet fuel requirements at an average price of $67 per barrel through to March 2027.

International Airlines Group has also hedged a large portion of its future fuel consumption, locking in prices for around 62 per cent of its fuel needs for 2026.

Similarly, easyJet said it has hedged about 62 per cent of its fuel requirements for the upcoming summer season at an average price of $68.80 per barrel.

While these measures provide some protection against sudden spikes, analysts warn that sustained price increases would still filter through into airline costs over time as hedges expire and new contracts are negotiated.

Industry observers say the key factor determining how severe the crisis becomes will be the duration of the disruption to Gulf energy flows and whether shipping through the Strait of Hormuz can resume safely.

If the blockade persists or the conflict spreads further across the region, aviation fuel prices could remain elevated for months, forcing airlines to absorb higher costs or pass them on to passengers through higher ticket prices.

For now, airlines and investors alike are watching energy markets closely as geopolitical tensions continue to ripple through the global aviation industry.

Read more:

Airlines hit by jet fuel surge as Iran conflict disrupts supply